Gas-to-liquids (GTL), a process that converts natural gas to liquid fuels such as gasoline, diesel and jet fuel rather than producing these fuels from crude oil, has barely penetrated the energy market, with fewer than 10 industrial-scale plants currently in operation around the world. For decades, the relative cost of crude oil to natural gas has limited investment in GTL, but persistently low U.S. natural gas prices in recent years have boosted this ratio to an all-time-high, leading investors to reconsider the potential of GTL.

A new study by researchers at the MIT Joint Program on the Science and Policy of Global Change explores the long-term viability/profitability of GTL, and concludes definitively that GTL is unlikely to emerge as a profitable industry in the coming decades. Without dramatic efficiency improvements and cost reductions, GTL will remain too expensive to make liquefied natural gas competitive with refined crude oil in the transportation sector (the primary determinant of crude oil pricing). This conclusion holds regardless of whether restrictions are placed on carbon emissions—limits that would bolster GTL’s profitability.

The study, “The economic viability of Gas-to-Liquids technology and the crude oil-natural gas price relationship,” appears in the journal Energy Economics.

“New capital investments in GTL need to demonstrate their profitability on a forward-looking basis,” says David Ramberg, the study’s lead author. Formerly a research assistant with the MIT Joint Program and PhD student in the MIT Technology and Policy Program, Ramberg is now a senior demand planner and data engineer at Amazon. “Our research shows that with any carbon constraints, GTL technology is not viable. Even without a carbon cap, the prospects for GTL are not bright because it needs a certain price ratio of oil to natural gas: relatively high oil prices and relatively low natural gas prices. We tested the potential futures and concluded that large-scale deployment of GTL is not economical.”

To obtain their findings, Ramberg and his team integrated GTL production into the MIT Economic Projection and Policy Analysis (EPPA) model. Using the model to investigate conditions under which evolving GTL technology could gain a substantial share of the energy market and reduce the oil-natural gas price ratio, they projected how new technology will change the overlapping oil and gas infrastructure, how people will use the two fuels, and how those changes will affect their relative prices.

With their projections indicating no significant role for GTL for the foreseeable future, the researchers concluded that the U.S. transportation sector will remain dominated by oil, but will see expanded use of electric vehicles and biofuels if more robust carbon emissions restrictions are applied.

“As carbon limits become more stringent, the impact of these alternative technologies on the crude oil/natural gas price ratio will be much more pronounced than that of GTL,” says MIT Joint Program Deputy Director Sergey Paltsev, one of the study’s co-authors. “We will be using our EPPA model to probe these impacts on energy prices and the energy mix more fully.”

This research was funded in part by BP, the MIT Energy Initiative (MITEI) ENI Energy Fellowship, the MITEI Martin Family Fellowship and sponsors of MIT's Joint Program.

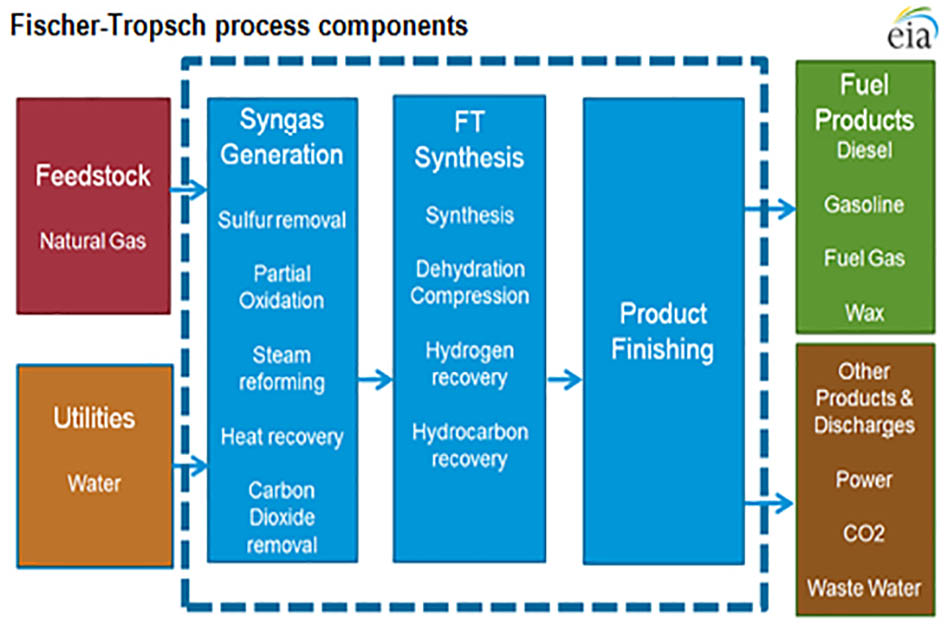

Photo: The most common technique used at GTL facilities is Fischer-Tropsch (F-T) synthesis. (Source: U.S. Energy Information Administration)